Covered call writers and put-sellers must set goals regarding targeted premium returns before entering trades. These objectives are based on personal risk tolerance, market assessment and chart technicals. One of the most flagrant mistakes made by option sellers is to make trade decisions based on the highest premium returns. Covered call writing and put-selling are conservative option strategies geared to conservative investors who have capital preservation as a key strategy goal. This article will highlight a trade initiated by a member of an investment club who asked me to analyze the trade.

Proposed trade with PTLA (Portola Pharmaceuticals, Inc.)

- Buy PTLA at $39.00

- Sell $35.00 1-month call at $9.10

Analysis

An in-the-money strike was selected indicating a defensive posture in the trade where the intrinsic value component will protect the time value component. This will generate additional downside protection but not allow for additional share appreciation potential profit.

Options chain for PTLA on 6/23/2017

PTLA: Options Chain on 6/23/2017

Analysis

The $35.00 strike has adequate open interest (545 contracts) and a spread of $7.40 – 10.90. A “negotiated price” of $9.10 was accepted.

Calculations with the Ellman Calculator multiple tab

PTLA Calculations with The Ellman Calculator

Analysis

An initial time value return of 14.6% with a downside protection (of that initial profit) of 10.3% is huge and seems too good to be true on the surface. In fact, it is too good to be true. Whenever there is enormous premium returns we know that it is because the underlying security is extremely volatile. High implied volatility translates into high risk as share value can decline below the breakeven, $29.90 in this scenario.

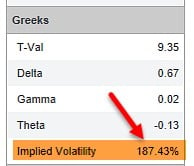

Option Greeks and implied volatility

PTLA Option Greeks

Analysis

The implied volatility calculated for this $35.00 in-the-money call option is a staggering 187.43%, more than 20 times that of the S&P 500 on 6/23/2017. This is the reason for the great returns but hidden in the weeds lies the immense risk preparing to rear its ugly head.

Discussion

The amount of profit we stand to generate from investment vehicles is directly related to the degree of risk we are willing to assume. We should never be enticed by high premium returns until we have analyzed the amount of risk we are about to incur and make an assessment if it meets our personal risk tolerance profile.

Upcoming speaking event

Orlando Money Show

February 8th – 11th, 2018

Market tone

Global dipped slightly lower this week along with an increase in volatility. The price of a barrel of West Texas Intermediate crude oil fell about $1 to $56.10. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), rose to 11.43 from 11.10 a week ago. This week’s economic and international news of importance:

- The US House of Representatives passed its version of the Republican tax bill by a vote of 227–205

- The Senate Finance Committee passed its version of the bill late Thursday, with the full Senate expected to vote after Thanksgiving

- Japan reported its seventh consecutive quarter of growth in the third quarter, the longest streak in more than 15 years

- Europe is experiencing the fastest growth rate in a decade, rising 2.5% year over year, which is a faster pace than the 2.3% US rate

- The United States, however, experienced stronger growth in Q3 than the Eurozone

- Venezuela and state-owned oil company Petróleos de Venezuela (PDVSA) were declared to be in selective default by the three major credit rating agencies

- UK prime minister Theresa May’s continued leadership of the Conservative Party was called into question last weekend as the Sunday Times reported that 40 members of her party have agreed to sign a letter of no confidence

- According to FactSet Research, companies who make more than 50% of their sales outside the US showed much faster earnings growth in the third quarter than companies whose overseas sales come in at less than 50%

- For the S&P 500 Index as a whole, earnings growth is running around 6.1

- Those with greater sales outside the US saw Q3 revenues jump 10% year over year, while those with mostly US sales rose 4.2%

THE WEEK AHEAD

Mon Nov 20th

- None

Tue Nov 21th

- US: Existing home sales

Wed Nov 22nd

- US: Durable goods, Fed minutes

Thu Nov 23rd

- UK: Q3 GDP

- Eurozone: Flash purchasing managers’ indices

- US: Markets closed for Thanksgiving

- Canada: Retail sales

Fri Nov 24th

- US: Flash PMIs

For the week, the S&P 500 dipped by 0.13% for a year-to-date return of 15.19%

Summary

IBD: Market in confirmed uptrend

GMI: 6/6- Buy signal since market close of August 31, 2017

BCI: My portfolio makeup reflects a neutral bias, selling an equal number of out-of-the-money and in-the-money calls. Waiting to see how the vote on the new tax plan plays out before taking a more bullish stance. Outside of this concern the global economy is performing well.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to a neutral outlook. In the past six months, the S&P 500 was up 9% while the VIX (11.43) moved up by 9%.

Much success to all,

Alan and the BCI team