Option trading basics incorporates fundamental, technical and common sense decisions. One of these, as it relates to covered call writing, is selecting a strike price for the short options position. In bearish and volatile markets I tend to favor the in-the-money strike.

Before I address this matter, let’s review the pros and cons of each type of strike price:

Out-Of-The-Money:

This gives us upside potential in addition to the option return but no downside protection of the initial profit. If we buy a stock @ $28 and sell the $30 call, we have the possibility to earn an additional $2 per share if the equity appreciates from $28 to $30 or beyond. If the stock goes down in value during the 1-month contract period, the profit will be decreased or lost (unless we invoke an exit strategy).

At-The-Money Strike:

This type of strike will normally give us the highest initial option return but offers no upside potential or downside protection. If we purchase a stock @ $30 and sell the $30 call, our option return will be impressive but we will not participate in any share appreciation nor will we have any insurance if the stock declines in value. Bear in mind that when I reference downside protection I am referring to protection of the initial option profit as opposed to the breakeven which is always the entire option premium.

In-The-Money Strike:

Here we receive option profit plus downside protection but no upside potential. If we buy a stock @ $32 and sell the $30 call, we receive an option profit plus protection down to $30. In other words, if our shares depreciate in value from $32 to $30, our option profit is protected. Let’s examine this in more detail.

Option Value as it relates to Strike price:

In my books and DVDs this matter is discussed under the heading of option basics. An option premium is broken down into two components:

1- Intrinsic Value- The value of an option if it were to expire immediately with the underlying stock at its current price; the amount by which the stock is in-the-money. For these call options, it is the positive difference between the stock price and the strike price. In the above example, it would be $2 (32 – 30). Only in-the-money strikes create intrinsic value.

2- Time Value- The portion of the option premium that is attributable to the amount of time remaining until expiration Friday. Time value = Option premium – Intrinsic value. All strikes have time value (with the possible exception of deep-deep-in-the-money strikes) but at-the-money and out-of-the-money strikes have ONLY time value.

What makes the I-T-M strike so special ?

This is the only strike that offers intrinsic value as a component of its option premium. In the above example, if we sell a $30 call on a stock trading @ $32, we receive $2 of intrinsic value to start and then time value on top of that. The time value is our actual profit because if our shares are assigned and sold @ $30 (a strong likelihood), we lose $2 per share on the sale of the stock. Therefore, we do not include the intrinsic value in our profit. However, this money is protecting us from $32 to $30. For my computations, I use this $2 to “buy down” the purchase price of my stock. Instead of saying that I bought a $32 stock and received an option premium of $3.50, I enter it as if I purchased a stock for $30 and received an option premium of $1.50. If we receive an option premium of $3.50 per share when selling the $30 call, there is $2 in intrinsic value and $1.50 in time value. The profit is time value divided by the “bought down” purchase price. It would look like this:

ROO = 150/3000 = 5% 1-month return or 60% annualized.

Downside protection = 200/3200 = 6.3%

Therefore, we are guaranteed a 5% 1-month return as long as our shares do not depreciate by more than 6.3% in that month.

The principles behind selling the in-the-money strike:

Successful covered call writing is not about selecting the only obvious choice using some magical formula that can be employed in every situation. There are many factors to incorporate into our investment decisions and no two scenarios are precisely the same. We can, however, use the Blue Collar mission statement of incorporating sound fundamental and technical principles along with our common sense to come to intelligent and informed conclusions. Think of yourself as the artist who incorporates his well-thought-out strokes into an eventual masterpiece. How many Picassos are created with a paint-by-the-numbers kit?

I view an I-T-M strike as an option with an insurance policy. Now this policy is free but it does eliminate an opportunity. It’s free because the option buyer is paying for it when we sell the call. The opportunity lost is any potential for share appreciation. So when would the odds favor us to opt for the I-T-M strike versus the O-T-M strike? Here are the situations when I am most likely to sell an I-T-M strike:

1- An extremely volatile or declining market

2- Technical analysis of the stock demonstrates mixed indicators.

3- An uptrending chart pattern but in a volatile manner (the Scouter Rating will eliminate many of these- see page 31 of Encyclopedia….).

4- Part of my laddering of strikes procedure: even in normal markets I will incorporate some I-T-M strikes as a way to diversify strikes.

Real life example- EBAY

EBAY is a stock currently on our premium watch list (August, 2012). The technical indicators show a positive chart pattern but with mixed to negative confirming indicators. Here is the current chart:

The current market value is $44.05. The stock technicals are mixed and the market tone is cautiously bullish. Those with low risk-tolerance (I’m guilty as charged) may opt for the $42 or $43 in-the-money call. Let’s work out the calculations. Since there is only one week remaining until the August options expire, let’s look at the September calls:

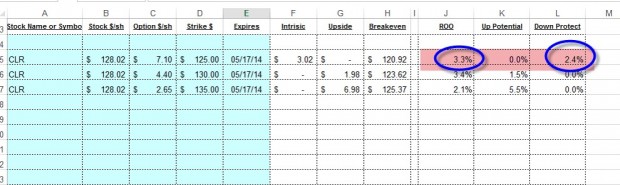

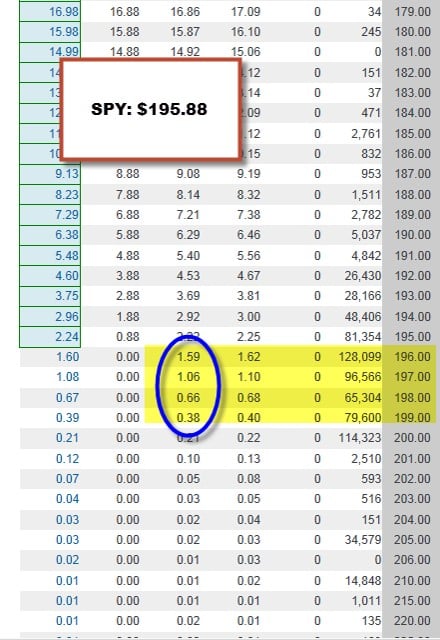

In-the-money strikes: Accessing the options chain:

Calculating returns for the $42 and $43 in-the-money strikes: The Ellman Calculator Single Tab:

Calculation results:

Yellow field: The $42 strike yields a 2.2%, 5-week return with a downside protection of 4.7%.

Green field: The $43 strike yields a 3.0%, 5-week return with a 2.4% downside protection.

Many of our readers have asked why I have been highlighting mainly I-T-M strikes of late. The reason has to do with the extreme market volatility and the fact that I am a conservative investor with low risk tolerance. More aggressive investors might opt for the O-T-M strike. There is no right or wrong as long as you are making an informed decision factoring in and understanding all available information. Remember that all these calculations are done for you automatically using the Ellman Calculator.

Conclusion:

Strike selection is based on several factors including general market assessment, chart technicals, and personal risk tolerance. The in-the-money strike should be considered in volatile and bearish market environments and when technicals are mixed. Those with lower risk tolerance will generate additional downside protection that may be more suitable to their investment needs.

Upcoming live events:

September 14th, 2012: Forex and Options Traders Expo/ Paris Hotel, Las Vegas. Register FREE:

http://www.moneyshow.com/tradeshow/Las_vegas/forex/speakers/speaker_listing/

November 10th, 2012: Chicago Chapter AAII/ University Club, Chicago

April 20th, 2013: Atlanta Options Investor Club/ Georgia State University, Alpharetta, Georgia

September 17th, 2013: Philadelphia Chapter AAII/ Plymouth Meeting, Pennsylvania

Market tone:

This week’s economic reports raised hope for stronger economic growth:

- The Labor Department reported initial jobless claims @ 361,000, 6,000 less than expected

- Consumer credit (the level of consumer credit is considered a barometer of consumers’ financial health and an indicator of potential spending patterns) grew $6.5 billion in June, less than the $11 billion anticipated

- The US trade gap decreased from $46 billion to $42.9 billion in June. It was the 3rd consecutive monthly decline and a positive sign for improved GDP growth

- Non-farm productivity, which measure worker output/hour, rose at an annual rate of 1.6% in the 2nd quarter (a rise of 0.5% was expected) after a 0.5% decline in the 1st quarter

For the week, the S&P 500 rose by 1.1% for a year-to-date return of 13.3% including dividends.

Summary:

IBD: Confirmed uptrend

BCI: Moderately bullish and adding to my out-of-the-money positions

Thanks for your interest and support of our BCI methodology,

Alan (alan@thebluecollarinvestor.com)