A covered call writing-like strategy involves buying deep in-the-money LEAPS options and then selling short-term slightly out-of-the-money call options. Leaps become a stock surrogate. The term Leaps stands for Long Term Equity AnticiPation Security. They have expiration dates up to 2 1/2 years out.

Defining spreads

Technically, covered call writing with LEAPS is known as a diagonal spread because both options have the following characteristics:

- Same stock

- Different strikes

- Different expiration dates

This differs from a calendar spread which has the following characteristics:

- Same stock

- Same strike

- Different expiration dates

Hypothetical example

- BCI trading at $60.00 in August, 2015

- Buy 1 x January, 2017 $40.00 LEAPS for $22.00

- Sell 1 x September $65.00 call for 2.00

Advantages of LEAPS

- Risking less capital ($22.00 per share as opposed to $60.00 per share)

- Higher rate of return (ROI) as gains are magnified due to leverage

Disadvantages of LEAPS

- Requires more active management because we don’t own stocks to deliver

- Smaller pool of stocks to select from (fewer stocks have LEAPS compared to Monthlys)

- Wider bid-ask spreads than stocks

- Leverage works both ways with losses also magnified

Outcomes

Best case scenario

Ideally, we would like share price to rise $0.01 below the $65.00 strike and having the short call expire worthless. Here we would have generated $2.00 in option premium plus $4.99 in unrealized share appreciation. We can then write another short call.

Worst case scenario

Our maximum loss, if share price moves to $0.00 is $22.00 – $2.00 = $20.00 per share. This, of course, assumes no position management, an unrealistic assumption for Blue Collar Investors.

Stock price remains the same

The short call expires worthless and we write the next month’s (October) slightly out-of-the-money call

Stock price moves up slightly

We can close both legs of the trade for a small gain. We may also opt to take no action in hopes of the option expiring worthless if share price remains below the strike price.

Stock price moves down slightly

We can close both legs of the trade for a small loss. We may also decide to take no action if the decline is minimal and write another call the next month.

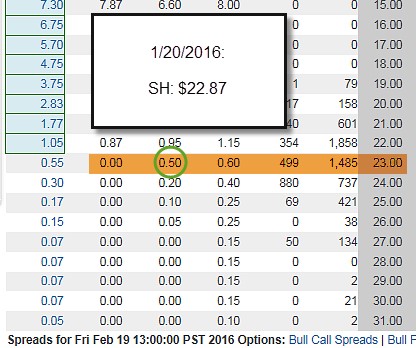

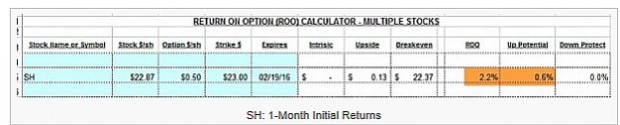

Stock price moves above the $65.00 strike

This is where our management skills come into play. Let’s say the share price moves up from $60.00 to $68.00. As expiration of the short call approaches, the premium will be slightly above $3.00, say $3.10 ($3.00 of intrinsic value + $0.10 of time value). The $40.00 LEAPS is $28.00 in-the-money plus has a larger time value component, let’s say $1.50 for an estimated premium of $29.50. Now, if we exercise the LEAPS and sell the stock for $65.00 from short-call exercise, our net gain in $25.00. However, if we close the spread by buying back the short call for $3.10 and sell the LEAPS for $29.50, we have a net credit of $26.40, an additional profit of $140.00 per contract.

We do have one other course of action here. We can roll the option to the next month $60.00 call or roll out-and-up to a higher strike. The calculations will dictate whether this latter strategy meets our goals.

How to structure a LEAPS/Covered call trade

These trades should be set up such that, if both legs are closed, it is closed at a profit:

Difference between the two strikes + premium generated from the short call must be greater than the cost of the LEAPS option.

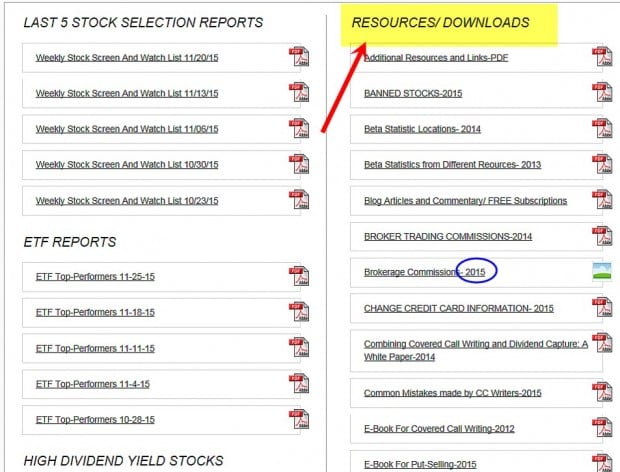

Brokerage concerns

We will need special approval to use this strategy, probably a higher level of approval than for traditional covered call writing. We will be asked about our goals, risk tolerance, knowledge of options trading as well as portfolio balances and net worth. These requirements are broker specific so we must ask our broker for this information.

Self-directed IRA accounts

As a general rule of thumb, traditional covered call writing is permitted in self-directed IRAs but LEAPS covered call writing is not.

Discussion

Using LEAPS as a stock surrogate with covered call writing has its advantages and disadvantages. Each investor must measure his own risk tolerance to make a determination as to whether this strategy has a place in the family portfolio.

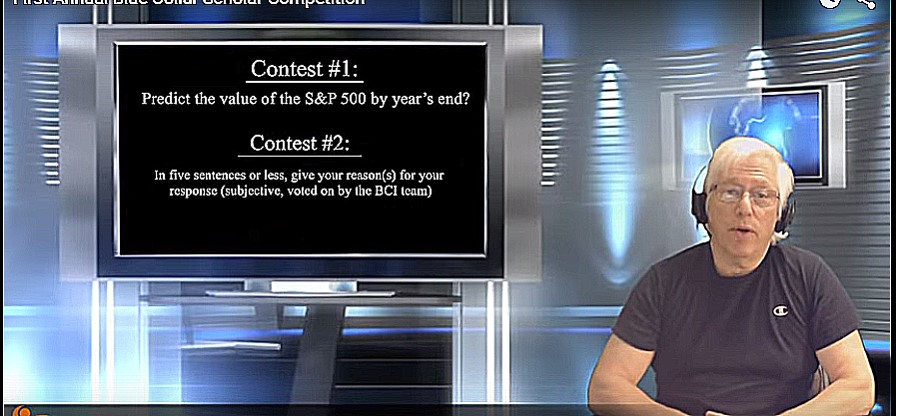

Blue Collar Scholar Competition: Great prizes and a worthy charity

![Blue Collar Scholar Competition- 2015]()

Blue Collar Scholar Competition- 2015

We’re trying something new thanks to Jay’s idea. Here are the parameters we are using: Two contests running simultaneously with six prizes:

Contest #1: What will be the value of the S&P 500 by year’s end?

Contest #2: In five sentences or less, give your reason(s) for your response (subjective, voted on by the BCI team)

Prizes in each category (total of 6).

Donation to the USO (United Services Organization) of $5000.00 worth of books.

Click on this link for our contest video and entry form.

Next live appearance

American Association of Individual Investors National Conference

Bally’s Hotel

Las Vegas, Nevada

November 7th – November 9th

Sunday November 8th @ 8:30 AM – 9:45 AM (Alan’s seminar)

Exhibit Hall # 313

***Event is sold out

Market tone

US stocks rose overall while global markets were mixed. US economic reports were also mixed but in line with expectations. Data from Japan and the eurozone were stronger than anticipated. This week’s reports:

US economic growth slowed to a 1.5% annual rate in the third quarter mainly caused by a large inventory impediment that deducted 1.44 percentage points off the GDP

The US Federal Reserve maintained low interest rates this week, but would consider a rate increase at its December meeting

New US single-family home sales fell in September to close to a one-year low after a few monthly gains

Sales fell 11.5% to a seasonally adjusted annual rate of 468,000 homes

The S&P/Case-Shiller home price index rose 4.7% in the 12 months ending in August, up slightly from July

US consumer spending rose just 0.1% in September after increasing 0.3% and 0.4% in July and August. September’s increase was the smallest since March

The price index for personal consumption expenditures, the Fed’s favored inflation gauge, fell 0.1% in September and rose just 0.2% from a year ago

The Conference Board’s Consumer Confidence Index fell from 102.6 in September to 97.6 in October

US durable goods orders fell a seasonally adjusted 1.2% in September after a revised 3% drop in August

Initial jobless claims increased 1,000 to 260,000 for the week ending October 24th

Continuing claims fell 37,000 to 2.14 million for the week ending October 17th, the lowest in 15 years

For the week, the S&P 500 rose by 0.20% for a year to date return of 0.99%.

Summary

IBD: Confirmed uptrend

GMI: 6/6- Buy signal since market close of October 19, 2015

BCI: Cautiously bullish using an equal number of in-the-money and out-of-the-money strikes.

Wishing you the best in investing,

Alan (alan@thebluecollarinvestor.com)

![]()